Executive Summary

I have filed a set of six compliance reports with the United States District Court for the District of Columbia as Monitor of the National Mortgage Settlement (NMS or Settlement). This document summarizes these reports, which detail my review of each servicer’s performance on the Settlement’s servicing reforms. This report includes:

- An overview of the process through which my colleagues and I have reviewed the servicers’ performances on the Settlement’s servicing reforms;

- An update on the one servicer’s implementation of corrective action plans and related borrower remediation, first mentioned in prior reports

- Summaries of each servicer’s compliance for the first and second calendar quarters of 2015.

Seven servicers are now subject to the National Mortgage Settlement. This is my sixth report on the original servicers: Bank of America, Chase, Citi, Wells Fargo and the ResCap Parties, whose servicing assets were sold to Ocwen and Ditech (formerly Green Tree), as explained below. This is the first report to include SunTrust’s compliance. SunTrust entered into a separate consent judgment in September 2014 requiring the company to provide $500 million in consumer relief and comply with the NMS servicing standards.

This report does not include an update on Ocwen’s compliance. My team is still reviewing Ocwen’s compliance testing results for the first half of 2015. I will report my findings to the Court and to the public as soon as I am confident they are complete.

My review of Bank of America, Chase, Citi, Ditech, SunTrust and Wells Fargo did not uncover any failed metrics in the first half of 2015.

Sincerely,

Joseph A. Smith, Jr.

Introduction

As required by the National Mortgage Settlement (Settlement or NMS), I filed compliance reports with the United States District Court for the District of Columbia (the Court) for each servicer that is a party to the Settlement. The servicers include four of the original parties – Bank of America, N.A. (Bank of America), JP Morgan Chase Bank, N.A. (Chase), CitiMortgage, Inc. (Citi) and Wells Fargo & Company (Wells Fargo). Essentially all of the servicing assets of the fifth original servicer party, the ResCap Parties, were sold to and divided between Ocwen Financial Corporation (Ocwen) and Green Tree Servicing, LLC (Green Tree), pursuant to a February 5, 2013, bankruptcy court order. Accordingly, Ocwen and Green Tree, now Ditech Financial LLC (Ditech), are now subject to the NMS for the portions of their portfolios acquired from the ResCap Parties estate.1

In September 2014, the United States District Court for the District of Columbia entered a new consent judgment reflecting the agreement reached among SunTrust Mortgage, Inc. (SunTrust), the Consumer Financial Protection Bureau (CFPB), 49 states and the District of Columbia.

The reports I filed provide the results of my testing on compliance with the NMS servicing standards during the first and second quarters 2015. They are the sixth set of reports on the original four servicers, the fourth report on Ditech, and the first report on SunTrust. Copies of all the reports filed with the Court are available on my website, mortgageoversight.com.

Oversight Process

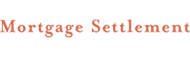

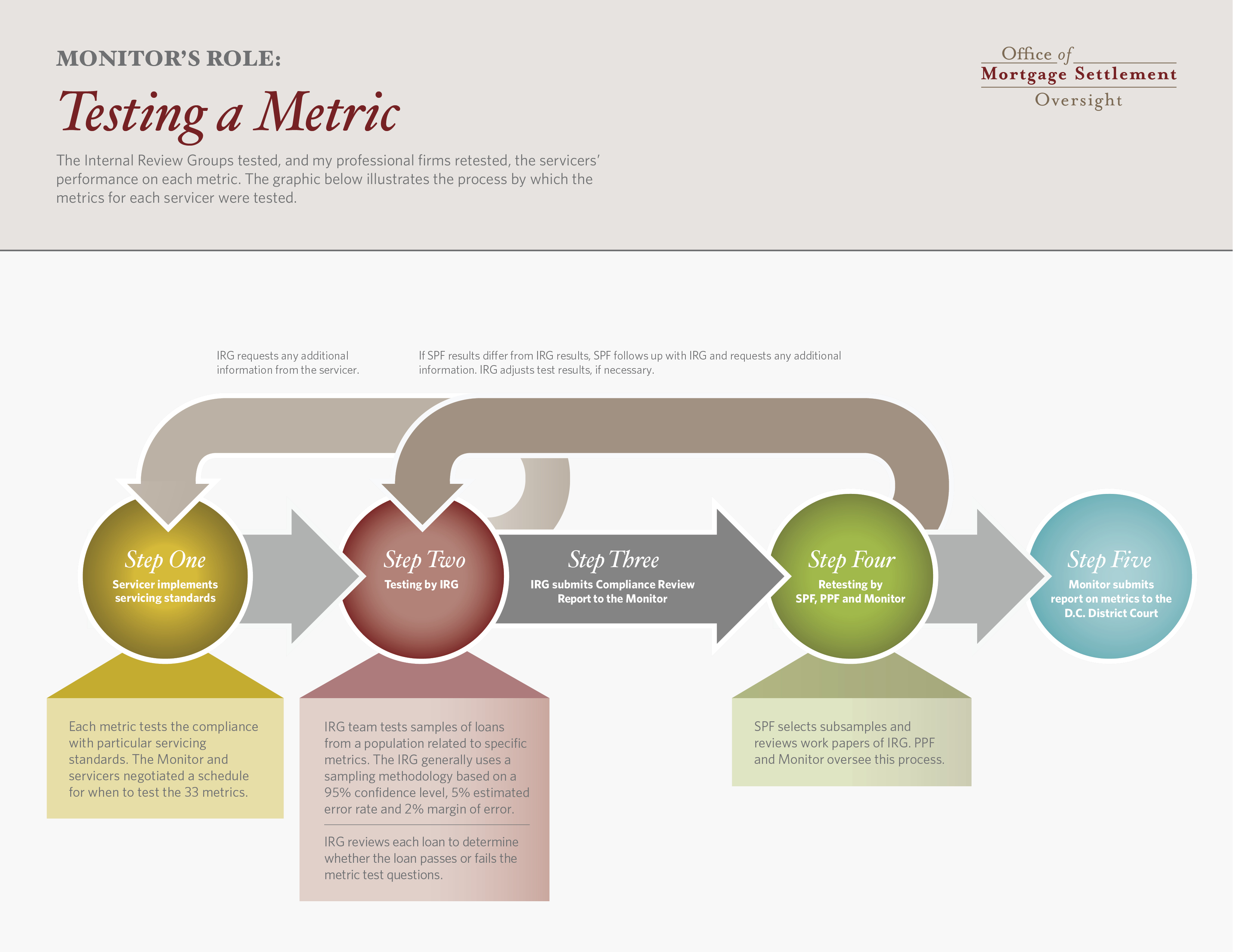

As Monitor, I evaluate the servicers using the 29 original metrics, or tests, enumerated in the Settlement and four additional metrics I negotiated with the servicers and the Monitoring Committee. These metrics determine whether the servicers adhered to the 304 servicing standards, or rules, outlined in the NMS. The Monitoring Committee comprises representatives from 15 states, the United States Department of Housing and Urban Development and the United States Department of Justice.

I continue to work closely with a team of professional firms to oversee the servicers’ compliance with the servicing standards. For more information about these professional firms and their roles in the monitoring process, please see my previous reports.

The servicers each follow work plans that I approved and to which the Monitoring Committee did not object. In these work plans, an internal review group (IRG) determines whether the servicers’ activities comply with the Settlement terms. More information on the IRGs and work plans can be found in my previous reports. I then work with my professionals to review the work of each servicer’s IRG. I determine if the IRG’s work is satisfactory and report my findings to the Court and the public.

Oversight Process

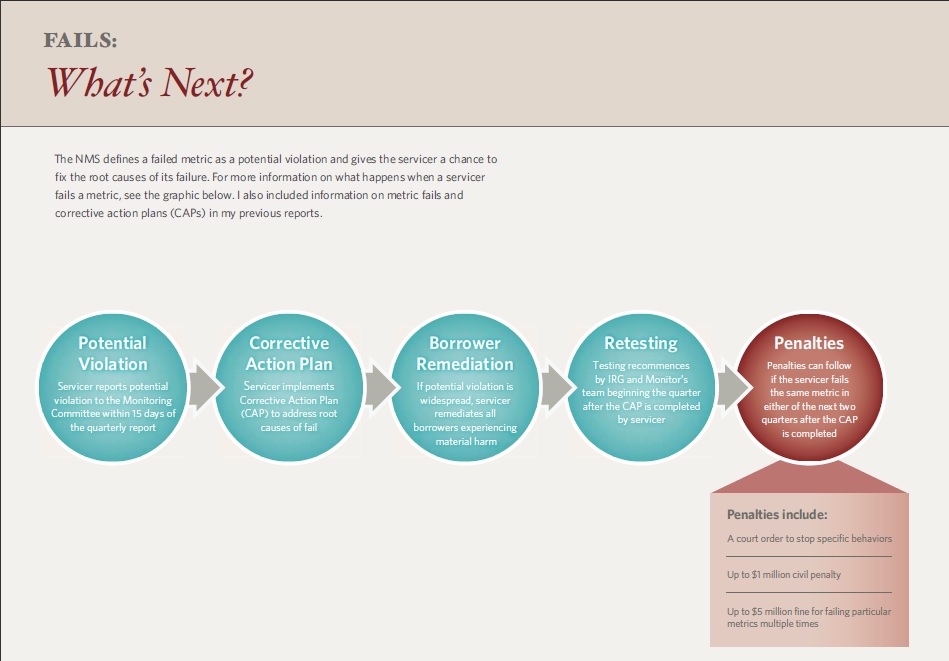

This report covers the first and second quarters 2015. During these periods, my professionals and I tested each of the servicers on up to 33 metrics.

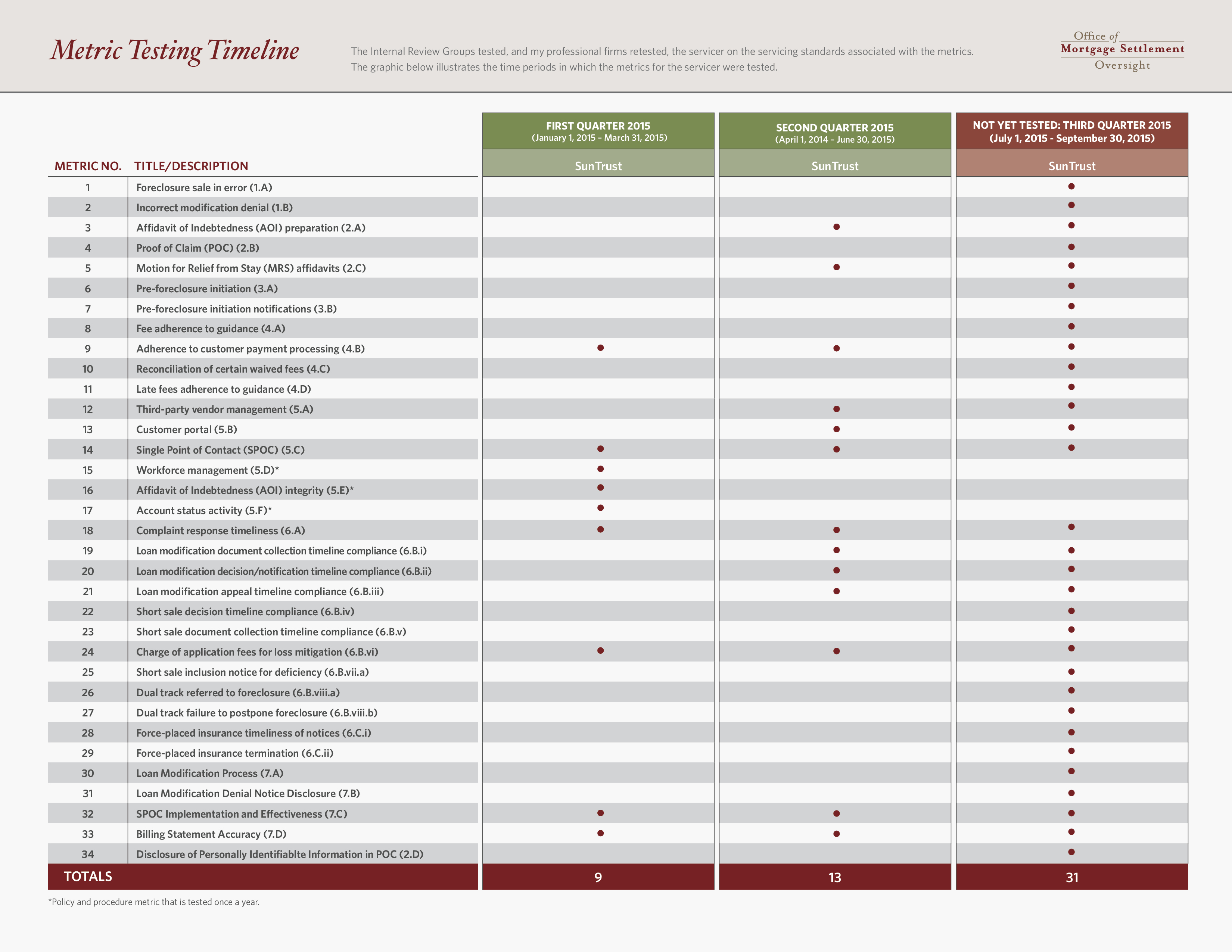

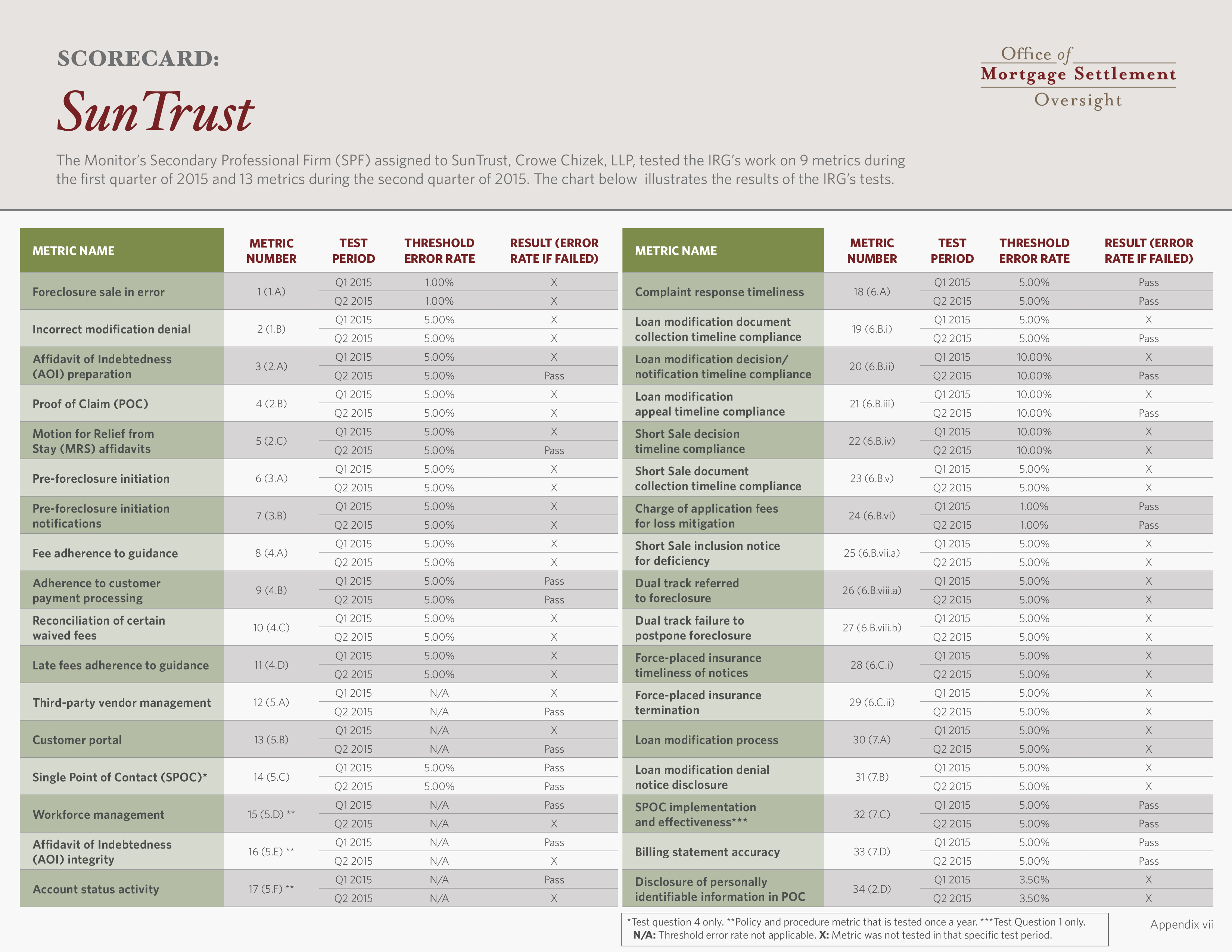

I allowed SunTrust to begin its compliance testing in phases as the bank implemented the servicing standards. My professionals tested SunTrust on nine metrics in the first quarter and thirteen in the second quarter 2015. For the third quarter 2015 and after, SunTrust will be subject to testing on all metrics.

The work to test the servicers in the first and second quarters 2015 involved 254 professionals, including my primary professional firms, secondary professional firms and other professionals who dedicated approximately 78,975 hours over a six-month period.

Click to view image

Click to view image

Bank of America Results

Neither Bank of America’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

Chase Results

Neither Chase’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

Citi Results

Neither Citi’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

Ditech Results

Neither Ditech’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

By January 1, 2015, Ditech had completed corrective action plans and remediation of all previous fails except Metrics 6, 10 and 19. These three fails have been cured, and the remediation for Metric 10 is complete. Remediation for Metric 6 is ongoing, and my professionals are in the process of reviewing Ditech’s remediation for Metric 19. More information can be found on the corrective action plans for all of Ditech’s fails in my previous report.

I will provide an update on Ditech’s remediation efforts for Metrics 6 and 19 in my next report.

SunTrust Results

Neither SunTrust’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

Wells Fargo Results

Neither Wells Fargo’s IRG nor my professionals found evidence of fails in any of the metrics tested for the first half of 2015.

Conclusion

As of the end of the third quarter 2015, the obligations of Bank of America, Chase, Citi, Ditech and Wells Fargo under the NMS sunset. The servicers are still required to follow similar rules under CFPB review, but the reviews I conduct will conclude after I report on my findings through that time, as the Settlement prescribes. I will report additional thoughts and findings on the Settlement’s work in the future.

Resources

1 The Court separately entered a consent judgment between Ocwen and government parties on February 26, 2014, as part of the NMS, thereby subjecting Ocwen’s entire portfolio to the Settlement’s requirements. Accordingly, beginning the third quarter of 2014, Ocwen’s entire portfolio is subject to the Settlement’s requirements