Executive Summary

The following report is an overview of my crediting of SunTrust’s consumer relief obligation under the National Mortgage Settlement (NMS or Settlement) through the end of 2014. Under the Settlement, SunTrust must provide $500 million in consumer relief by September 30, 2017. I have filed a report with the U.S. District Court for the District of Columbia (the Court) crediting SunTrust with $7,827,711 in consumer relief credit from the initial 100 loans SunTrust submitted through December 31, 2014.

SunTrust elected to submit 100 loans for crediting so that its Internal Review Group (IRG) could use this initial testing period to ensure that its testing protocols were appropriately designed. SunTrust advised me that, as of December 31, 2014, it had provided creditable relief to borrowers on other loans that were not included in the group of 100 loans and that it intends to submit those other loans to the IRG for validation at a later date. I consented to this approach.

Sincerely,

Joseph A. Smith, Jr.

Consumer Relief Assertion

Under the Settlement, SunTrust is required to provide $500 million in consumer relief by September 30, 2017. Of that, $475 million must be distributed in mortgage loan relief to distressed borrowers and $25 million must be extended as part of a refinancing program to current borrowers who would not otherwise qualify for a refinance under Servicer’s generally available refinance programs as of September 30, 2011. The Settlement agreement can be viewed here.

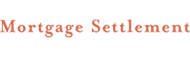

SunTrust’s IRG claimed credit in the amount of $7,819,979 as a result of 100 initial loans submitted for testing. Approximately 93 percent of the claimed credit was on loans in SunTrust’s mortgage loan portfolio that are held for investment. Fifty-six percent of SunTrust’s claimed credit was through First Lien Mortgage Modifications, 37 percent was through the Refinancing Program, and 7 percent was through the New Lending Program.

Consumer Relief Testing Results

My Primary Professional Firm (PPF), BDO Consulting, a division of BDO USA, LLP, reviewed the IRG’s assertion. My professionals tested each loan submitted and determined that SunTrust’s IRG had correctly calculated the credit that SunTrust had earned in refinancing and new lending. However, according to the PPF’s determination, the IRG had undervalued the amount of credit that SunTrust had earned from first lien mortgage modifications. As a result, the PPF determined that SunTrust had earned $7,827,711 in credit in relation to the 100 loans it had submitted.

The following table sets out a breakdown, by type of relief, of the consumer relief credit as validated and calculated by the IRG and the PPF.

| Testing Population | Loans Reviewed by PPF | Credit Amount Validated by IRG | Actual Credit Amount PPF Calculated | Amount Overstated/(Understated) |

|---|---|---|---|---|

| First Lien Mortgage Modifications | 30 | $4,344,508 | $4,352,240 | ($7,732) |

| Refinance Program | 30 | $2,887,971 | $2,887,971 | - |

| New Lending Program | 40 | $587,500 | $587,500 | - |

Consumer Relief Testing Results (continued)

The IRG and PPF documented their findings in their work papers and reported them to me. After I conducted an in-depth review of both the IRG’s and the PPF’s work papers, I found that SunTrust is entitled to the credit claimed, as calculated by the PPF. As a result, I have credited SunTrust with $7,827,711 toward its consumer relief obligation.

The following chart shows the results of the PPF’s loan-level retesting.

Summary and Conclusions

The professionals with whom I work and I have thoroughly reviewed and retested the consumer relief activities discussed in this report. After this review, I am confident that SunTrust has begun to progress toward meeting its requirements under the Settlement.

SunTrust informed me that, as of December 31, 2014, it had provided creditable relief to borrowers on other loans that were not included in the group of 100 loans the IRG tested. SunTrust plans to submit those other loans on a later date. SunTrust has also informed me that it plans to submit additional loans to me later this month. I will review and report my findings regarding that submission in my next report.