Executive Summary

After a review of the issues I found with Ocwen’s internal review group’s (IRG) integrity and subsequent review of its work to address these problems, I have reported to the Court that I now have a measure of assurance that the issues with Ocwen’s IRG’s independence, competency and capacity have been sufficiently addressed.

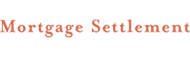

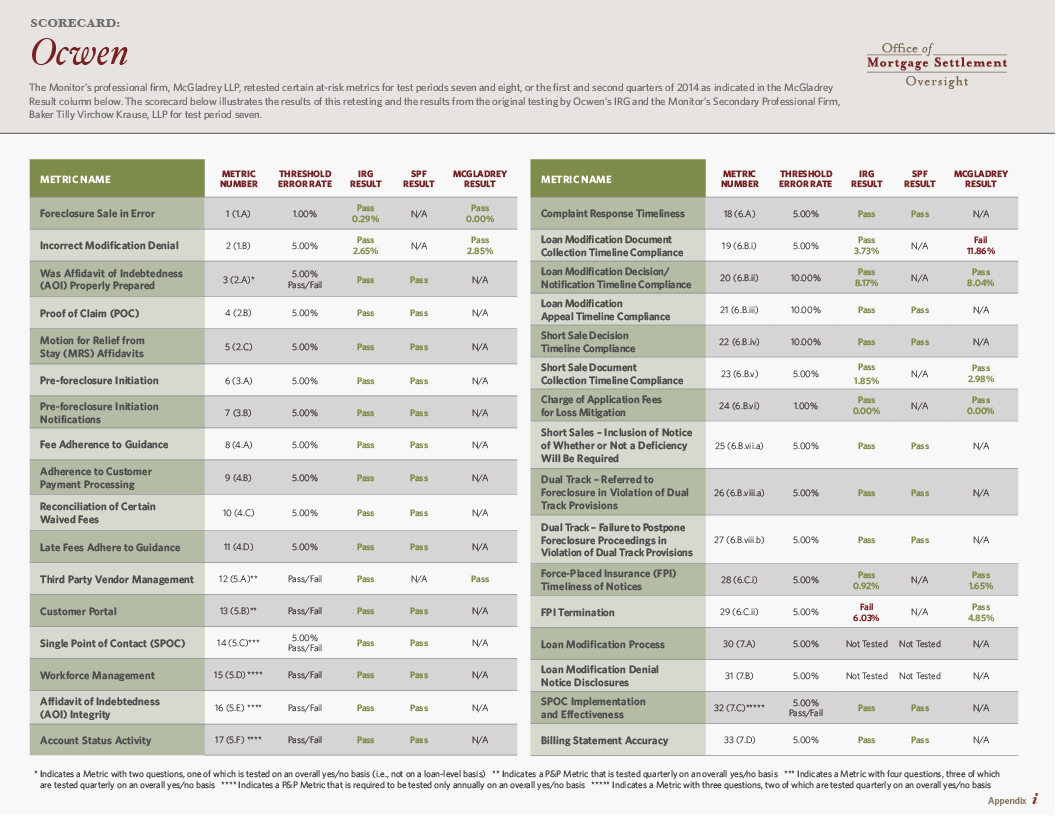

In May 2014, an Ocwen employee reported issues that called into question the independence of Ocwen’s IRG. I launched an investigation into these claims and determined that I could not rely on a portion of Ocwen’s work for the first quarter of 2014. I then directed McGladrey LLP (McGladrey), an independent firm, to retest Ocwen’s performance on certain at-risk metrics for the first and second quarters of 2014. The results of that testing are detailed in this report.

In October 2014, the New York State Superintendent of Financial Services raised issues concerning incorrect dates on certain correspondence from Ocwen to its consumers. Among other corrective actions, Ocwen has created a global corrective action plan to address its letter-dating issues (Global CAP).

Both issues are detailed in my Continued Oversight report and my second interim update on Ocwen.

Before reaching my conclusions regarding Ocwen’s IRG, my team and I: 1

- Retained McGladrey to independently retest metrics identified as “at-risk” for the first and second quarters of 2014.

- Approved corrective action plans (CAPs) Ocwen developed to fix the root causes of its failed metrics.

- Reviewed and validated the changes Ocwen made to its IRG. As I reported previously, Ocwen replaced the executive who led the IRG and otherwise reorganized employees, adopted corporate governance principles, and enhanced my access to information.

- Approved the Global CAP that Ocwen developed that intends to fix its letter-dating issues.

This report details McGladrey’s retesting results and Ocwen’s corrective action efforts and provides an update on Ocwen’s Global CAP.

Sincerely,

Joseph A. Smith, Jr.

Retesting Results

The extensive and independent testing I directed McGladrey to perform showed that, with the exception of Metric 19 in the first quarter of 2014, the IRG’s testing for both quarters of 2014 was not significantly different from McGladrey’s independent testing.

These results, along with the changes Ocwen made to its IRG, have given me a measure of assurance regarding my confidence in the current independence, capacity and competency of the IRG. These results and changes have also allowed me to determine that the IRG has sufficient ability to effectively implement and execute its work under the Settlement. For details on the retesting of “at-risk” metrics, see my Interim Report on Ocwen.

Corrective actions and remediation

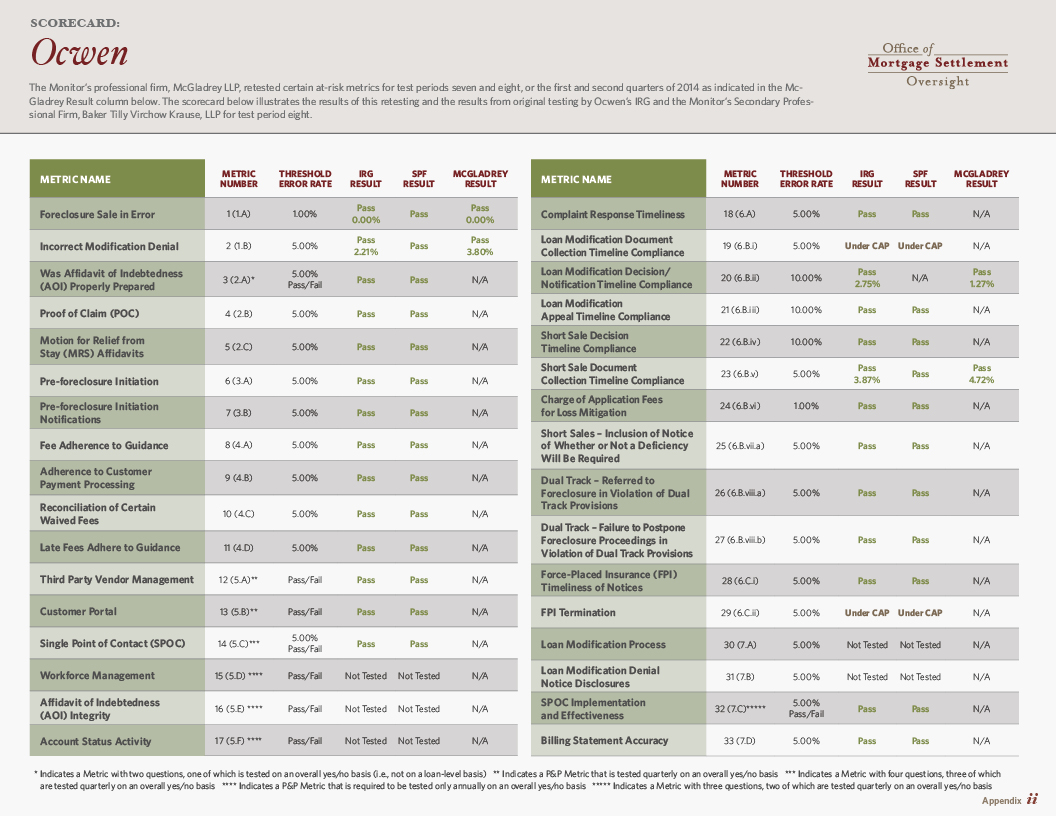

Metric 19 tests whether the servicer is complying with the requirement to notify borrowers of any missing or incomplete documents in a loan modification application in a timely manner. Ocwen submitted a CAP that identified and addressed the root cause of its fail. My professionals and I reviewed the CAP and determined that it should sufficiently address the fail. Ocwen is currently implementing the CAP, and cure period testing will resume in the third quarter of 2015.

Though I determined that the noncompliance was not widespread, Ocwen elected to treat Metric 19 as if it were widespread. Ocwen submitted a separate remediation plan to identify all impacted borrowers from December 1, 2013 to March 31, 2015. Ocwen is in the process of implementing the remediation plan. I will provide an update on the Metric 19 CAP and the related remediation efforts in my next report.

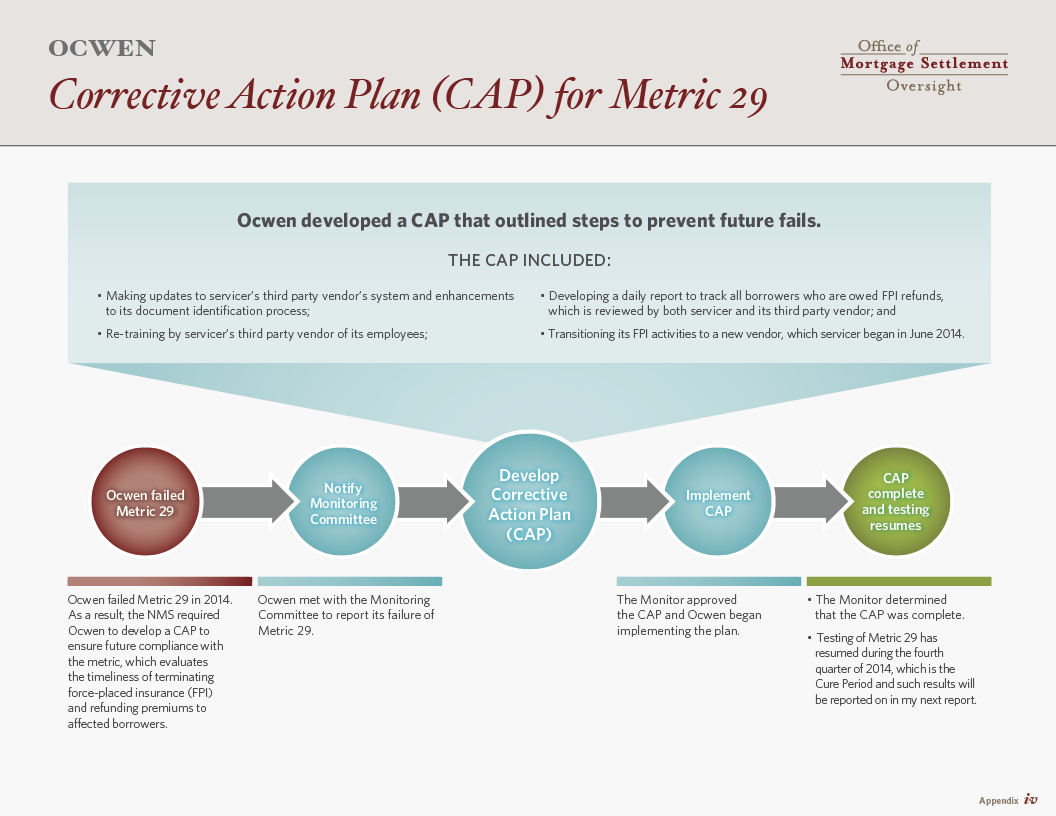

Metric 29 tests whether the servicer terminates force-placed insurance and refunds premiums to affected borrowers in a timely manner. Ocwen’s IRG originally reported it failed Metric 29, but McGladrey reported a pass by one single loan. Due to the difference in results of one loan, I consider the results substantially consistent. Notwithstanding McGladrey’s retesting results, Ocwen submitted a CAP that my professionals and I have reviewed and determined that Ocwen has satisfactorily completed. Metric 29 testing has resumed, and I will report an update on the cure period results in my next report.

Global letter-dating corrective action plan

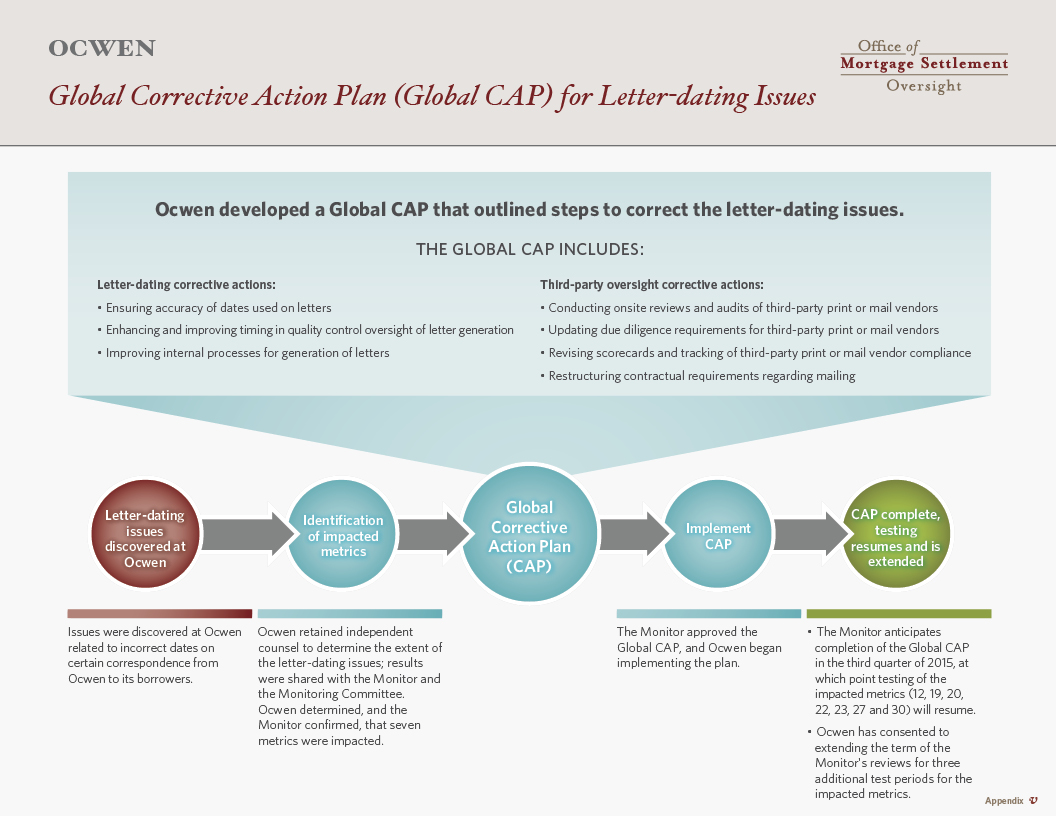

In my past reports on my investigation of Ocwen’s compliance issues, I also reported that Ocwen was taking corrective actions related to issues with incorrect dates on certain correspondence from Ocwen to its borrowers.

Ocwen’s investigation revealed that the letter-dating problems were caused by a programming error in its process for populating letter templates and a lack of adequate oversight of third-party print or mail vendors. Ocwen has undertaken the following corrective actions:

- Dedicated resources to improve operational systems and infrastructure

- Created a Global CAP intended to address these letter-dating issues, which I have approved

- Consented to extending the term of my reviews of certain impacted metrics2 for three additional test periods through December 31, 2017

Under the Global CAP, there will be rigorous testing to determine if Ocwen appropriately implements the CAP and corrects its letter-dating issues. I anticipate that the Global CAP will be completed, and the testing of the impacted metrics will resume in the third quarter of 2015.

Conclusion

I will report on Ocwen’s performance for the third and fourth calendar quarters of 2014 in the coming months. In that report and subsequent reports, I will provide updates on the status of Ocwen’s corrective actions regarding its letter-dating issues. I anticipate that Ocwen will complete these corrective actions and the IRG will resume its testing of the impacted metrics in the third quarter of 2015.

After reviewing McGladrey’s independent retesting of the at-risk metrics and the changes Ocwen made to its IRG, I have determined that Ocwen’s IRG is now sufficiently independent, competent and capable of effectively implementing and executing its work under the Settlement. My team and I will continue to monitor Ocwen’s IRG closely.

Resources

[1] The work to test Ocwen in test periods seven and eight involved 82 professionals, including my PPF, SPF, and other professionals who dedicated approximately 29,137 hours over a six-month period, including McGladrey’s retesting work which involved 17 professionals who dedicated approximately 12,379 hours.

[2] Metric 12: Third Party Vendor Management; Metric 19: Loan Modification Document Collection Timeline Compliance; Metric 20: Loan Modification Decision/Notification Timeline Compliance; Metric 22: Short Sale Decision Timeline Compliance; Metric 23: Short Sale Document Collection Timeline Compliance ; Metric 27: Failure to Postpone Foreclosure Proceedings in Violation of Dual Track Provisions; Metric 30: Loan Modification Process