Total Consumer Relief Overview

How much consumer and refinancing relief has been credited in total?

$20.7 Billion

37%

First Lien Principal Forgiveness

$7,589,277,740

17%

Refinancing Assistance

$3,587,672,814

15%

Second Lien Principal Forgiveness

$3,105,152,359

31%

Other Relief*

$6,410,554,173

*Primarily assistance for Short Sales and Deeds in Lieu of Foreclosure

$9.6 Billion

35%

First Lien Modifications

$3,365,196,272

23%

Second Lien Portfolio Modifications

$2,210,934,257

11%

Refinancing Program

$1,013,769,682

31%

Other Creditable Items*

$3,020,518,281

*Includes Enhanced Borrower Transitional Funds ($68,349,672) and Short Sales/Deeds-in-Lieu ($2,952,168,609)

$4.5 Billion

41%

First Lien Mortgage Modifications

$1,851,496,721

7%

Second Lien Portfolio Modifications

$308,672,792

14%

Refinancing Program

$623,424,705

38%

Other Creditable Items*

$1,679,929,992

*Includes Enhanced Borrower Transitional Funds ($136,957,159), Payment to an Unrelated 2nd Lien Holder ($9,780,918), Short Sales/Deeds-in-Lieu ($1,495,692,789), and REO Properties Donated ($37,499,126)

$1.8 Billion

29%

First Lien Mortgage Modifications

$524,062,757

19%

Second Lien Portfolio Modifications

$348,564,573

29%

Refinancing Program

$519,098,690

22%

Other Creditable Items*

$401,241,685

*Includes Enhanced Borrower Transitional Funds ($842,377), Payment to an Unrelated 2nd Lien Holder ($1,614,481), Short Sales/Deeds-in-Lieu ($316,159,020), and Forgiveness in Lieu of Foreclosure ($82,625,807)

$257 Million

51%

First Lien Mortgage Modifications

$130,324,492

9%

Second Lien Portfolio Modifications

$22,589,924

19%

Refinancing Program

$48,349,699

22%

Other Creditable Items*

$56,147,670

*Includes Short Sales/Deeds-in-Lieu ($39,425,927), Deficiency Waivers ($15,121,743), and Contribution to Borrower HOPE Loan Portal ($1,600,000).

$4.6 Billion

38%

First Lien Mortgage Modifications

$1,718,197,498

5%

Second Lien Portfolio Modifications

$214,390,813

30%

Refinancing Program

$1,383,030,038

27%

Other Creditable Items*

$1,252,716,545

*Includes Enhanced Borrower Transitional Funds ($12,675,400), Short Sales/Deeds-in-Lieu ($1,186,566,813), Payments to Unrelated 2nd Lien Holders ($9,133,711), Payments of Cash for Demolition of Property ($82,463), REO Properties Donated ($4,860,998), and Deficiency Waivers ($39,397,160).

Executive Summary

- $7,589,277,740, or 37 percent of total credited relief, of first lien principal forgiveness.

- $3,105,152,359, or 15 percent of total credited relief, of second lien forgiveness.

- $3,587,672,814, or 17 percent of total credited relief, of refinancing assistance.

- $6,410,554,173, or 31 percent of total credited relief, of other forms of relief, including, but not limited to, assistance related to short sales and deeds in lieu of foreclosure.

Seventy-six percent of such relief is related to loans owned by the servicers rather than serviced for other investors. In addition to a more detailed presentation of the relief summarized above, this report to the public includes:

- A discussion of the servicers’ relief obligations under the Settlement.

- An overview of the process through which my colleagues and I reviewed and confirmed the servicers’ relief activities.

- A report of my conclusions regarding the servicers’ satisfaction of their consumer relief and refinancing assistance obligations.

My team and I have thoroughly reviewed and tested the consumer relief and refinancing assistance activities discussed in this report. As a result, I am confident in concluding that the servicers have satisfied their obligations with regard to such activities. I will continue monitoring and reporting on the servicers’ performance in meeting their commitments regarding the servicing standards, or business practice reforms, required by the Settlement.

Sincerely, Joseph A. Smith, Jr.

Introduction

As Monitor of the National Mortgage Settlement (NMS or Settlement), I have filed reports with the United States District Court for the District of Columbia (the Court) certifying that each servicer party to the NMS has fulfilled its consumer relief and refinancing obligations.1 These reports provide the results of my review of the asserted consumer relief and refinancing activities (collectively, relief) for the final periods during which Bank of America, CitiMortgage (Citi), JPMorgan Chase (Chase) and Wells Fargo (Wells) completed their relief obligations. The ResCap Parties (ResCap) completed their relief obligations previously; my reports with respect to ResCap may be found here.

I previously filed interim reports with the Court detailing my review of the servicers’ relief activities through December 31, 2012. In addition, per the servicer’s request, I previously filed an interim report detailing my review of Wells’ relief activities through March 31, 2013. To provide a comprehensive overview of all the relief activity under the NMS, this summary discusses the total amount of relief provided by the servicers.

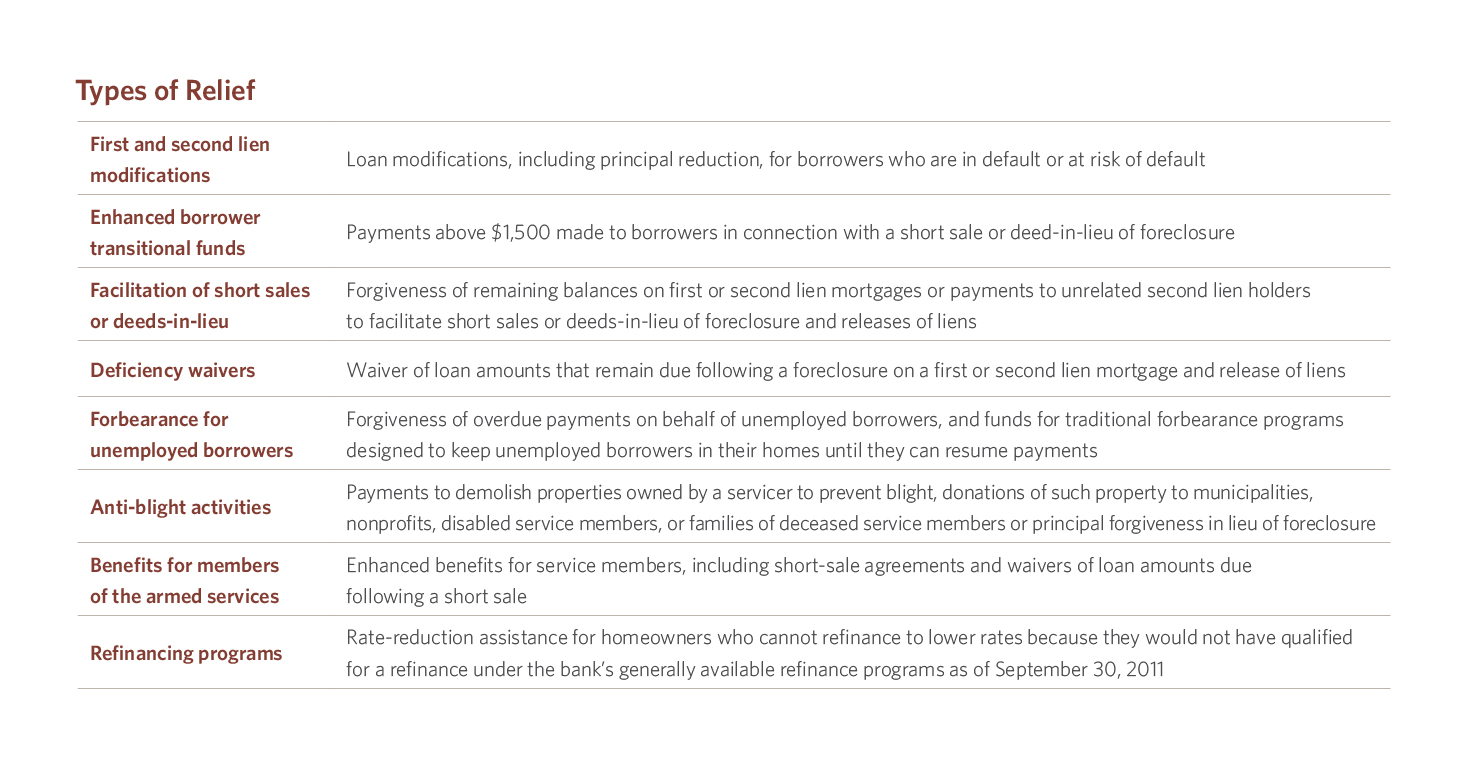

Structure of Relief under the Settlement

Under the Settlement, the servicers were required to provide relief to distressed borrowers within a three-year period, commencing March 1, 2012. The servicers’ relief obligations comprise the following:

- Consumer relief – such as principal forgiveness, loan modifications and short sale assistance – for distressed borrowers who meet the Settlement’s eligibility criteria.

- Refinancing assistance for certain borrowers who are current on their payments but who would not qualify for traditional refinancing because their loan-to-value ratios are too high.

Outline of the types of relief:

First and second lien modifications

Loan modifications, including principal reduction, for borrowers who are in default or at risk of default

Enhanced borrower transitional funds

Payments above $1,500 made to borrowers in connection with a short sale or deed-in-lieu of foreclosure

Facilitation of short sales or deeds-in-lieu

Forgiveness of remaining balances on first or second lien mortgages or payments to unrelated second lien holders to facilitate short sales or deeds-in-lieu of foreclosure and releases of liens

Deficiency waivers Waiver of loan amounts that remain due following a foreclosure on a first or second lien mortgage and release of liens

Forbearance for unemployed borrowers

Forgiveness of overdue payments on behalf of unemployed borrowers, and funds for traditional forbearance programs designed to keep unemployed borrowers in their homes until they can resume payments

Anti-blight activities

Payments to demolish properties owned by a servicer to prevent blight, donations of such property to municipalities, nonprofits, disabled service members, or families of deceased service members or principal forgiveness in lieu of foreclosure

Benefits for members of the armed services

Enhanced benefits for service members, including short-sale agreements and waivers of loan amounts due following a short sale

Refinancing programs

Rate-reduction assistance for homeowners who cannot refinance to lower rates because they would not have qualified for a refinance under the bank’s generally available refinance programs as of September 30, 2011

Click to view image

Click to view image

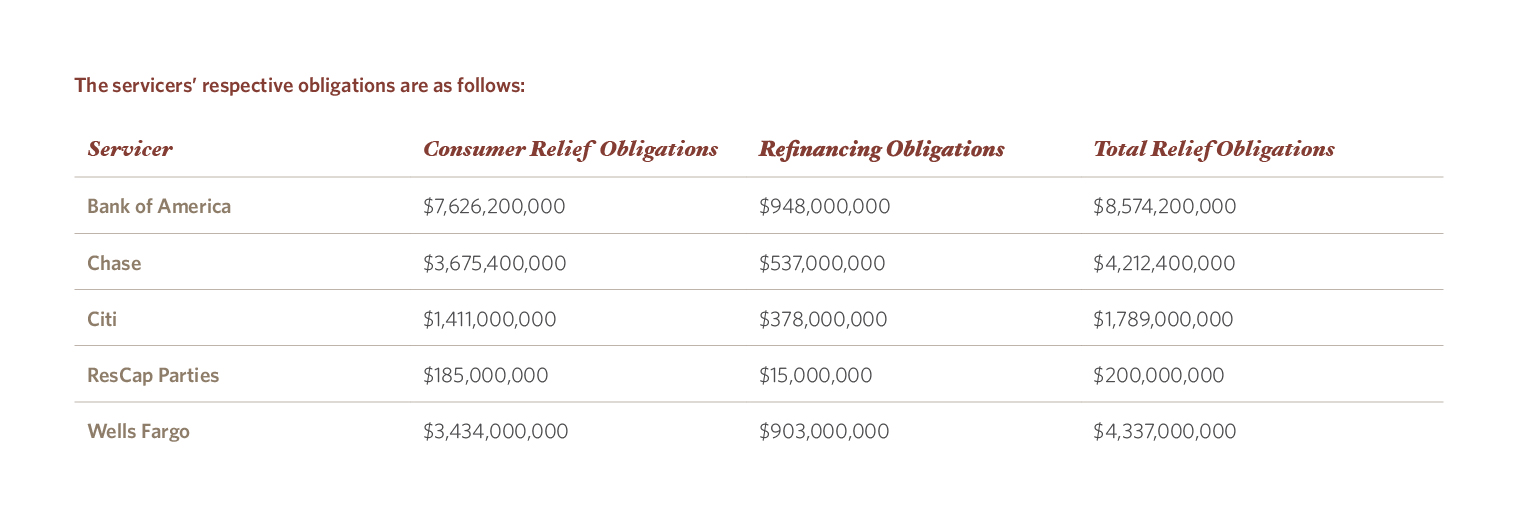

The Services respective obligations are as follows:

Bank of America

Consumer Relief Obligations: $7,626,200,000

Refinancing Obligations: $948,000,000

Total Relief Obligations: $8,574,200,000

Chase

Consumer Relief Obligations: $3,675,400,000

Refinancing Obligations: $537,000,000

Total Relief Obligations: $4,212,400,000

Citi

Consumer Relief Obligations: $1,411,000,000

Refinancing Obligations: $378,000,000

Total Relief Obligations: $1,789,400,000

ResCapParties

Consumer Relief Obligations: $185,000,000

Refinancing Obligations: $15,000,000

Total Relief Obligations: $200,000,000

Wells Fargo

Consumer Relief Obligations: $3,434,000,000

Refinancing Obligations: $903,000,000

Total Relief Obligations: $4,337,000,000

Click to view image

Click to view image

Credit for Consumer Relief

The Settlement defined various forms of consumer relief for which the servicers could receive credit. The servicers had some discretion as to the provision of these different kinds of relief to meet their overall obligations, although the Settlement established caps and minimums on certain types of relief.2

The Settlement requires that the servicer’s first lien mortgage modifications credit equal at least 30 percent of its total consumer relief requirement and that the combination of first and second lien modifications equal at least 60 percent, which can be reduced by 10 percent of overall consumer relief funds for excess refinancing. Under the Settlement, no more than 12.5 percent, 5 percent, 10 percent and 12 percent of the servicer’s total consumer relief funds may be through forgiveness of forbearance amounts on existing modifications, enhanced borrower transitional funds, deficiency waivers and anti-blight loss mitigation activities, respectively. Additionally, the Settlement requires that 85 percent of the first lien mortgages on occupied properties for which the servicer may get credit for first lien mortgage modifications have an unpaid principal balance before capitalization at or below the highest GSE conforming loan limit caps as of January 1, 2010.3

Furthermore, the servicers receive different amounts of credit depending on the type of consumer relief activity performed. Credit ranges from one dollar of credit for one dollar of certain types of first lien loan modifications to five cents of credit for a dollar of certain forbearance activities. This scoring system explains the difference between gross relief and credited relief under the NMS.

Credit for Refinancing Programs

Servicers could receive credit for refinancing first lien mortgages the servicer owns where the loan-to-value ratio is greater than 80 percent, provided that the borrower would not have qualified for a refinance under the servicer’s generally available refinance programs as of September 30, 2011. The amount of credit for refinancing was based on how much and for how long the homeowner’s interest payments were reduced.4

Bonuses and Penalties

The Settlement provided servicers a bonus credit of 25 percent for any first or second lien principal reduction or refinancing implemented on or before February 28, 2013. It also provided penalties from 125 percent to 140 percent of the unmet obligation if relief was not completed by the established deadlines.

Non-Creditable Requirements

The Settlement also imposed several non-creditable consumer relief requirements on each servicer, including that the servicer:

- Not implement any consumer relief “through policies that are intended to (i) disfavor a specific geography within or among states that are a party to [the Settlement] or (ii) discriminate against any protected class of borrowers;”

- Not require borrowers to waive or release legal claims and defenses as a condition of approval for loss mitigation;

- Modify second lien mortgages when a servicer party to the Settlement modifies a first lien mortgage;

- Extinguish certain second liens;

- Reduce credits claimed for consumer relief by the amount of state or federal incentive payments when they are the source of the claimed credit;

- Implement a refinancing program for all borrowers who meet specified minimum eligibility criteria;

- Identify and solicit active service members who have loans in the servicer’s own portfolio and qualify for refinancing; and

- Waive any deficiency amount remaining on loans in its own portfolio after certain short sales when the seller is an eligible service member.

Assertion and Testing of Relief

Crediting required the following actions by three distinct entities:

- The servicer performed the relief activities and reported to the state parties and me quarterly (State Reports). For testing and validation, it also reported its activities to its Internal Review Group (IRG), a group of servicer’s employees or contractors that is independent of the servicer’s mortgage loan servicing operations.

-

The IRG tested and confirmed the eligibility of the servicer’s relief activities and the amount of credited relief, and reported to me at the end of each calendar year (and more frequently under certain circumstances) and when the servicer asserted that it had satisfied its relief obligations.

-

As Monitor, I ultimately determined whether and when a servicer satisfied its obligations. I worked with my primary professional firm (PPF), BDO Consulting, to review the IRG’s satisfaction reports and conduct other procedures to determine whether the reports were correct and complete. My PPF also compared the relief information previously provided in the servicers’ State Reports with the information the servicers reported to their IRGs to determine whether there were any material inaccuracies, identify any apparent differences, and inquire with the servicers and IRGs to understand those differences. Finally, my PPF and I determined whether the servicers complied with the Settlement’s non-creditable requirements. After completing this work, the NMS required me to file reports with the Court detailing my conclusions on the servicer’s performance.

Each IRG, my colleagues and I used methods outlined in a work plan to determine that all or a portion of the servicer’s obligations had been performed or satisfied. These work plans were negotiated by the servicers and me and were reviewed by the Settlement’s Monitoring Committee, which is comprised of representatives of the U.S. Department of Housing and Urban Development, the U.S. Department of Justice, and 15 states.

In October 2013, I filed interim reports with the Court outlining the progress of four of the servicers toward their relief obligations through December 31, 2012.5 Once each servicer was confident it had completed its total relief requirements, it reported its activities to its IRG. The IRG then reviewed the servicer’s report and asserted to me the servicer’s progress toward its obligations. I received these reports from the IRGs of Bank of America and Chase in spring 2013 and from Citi and Wells in summer 2013. My PPF then reviewed the IRGs’ satisfaction reports and retested their testing samples to determine compliance.

Including the relief testing from all the interim and final reports, my team, comprising 65 individuals, spent more than 36,000 hours evaluating the five servicers’ cumulative relief activities under the NMS.

Monitors Role: Crediting Process

Determination of Performance

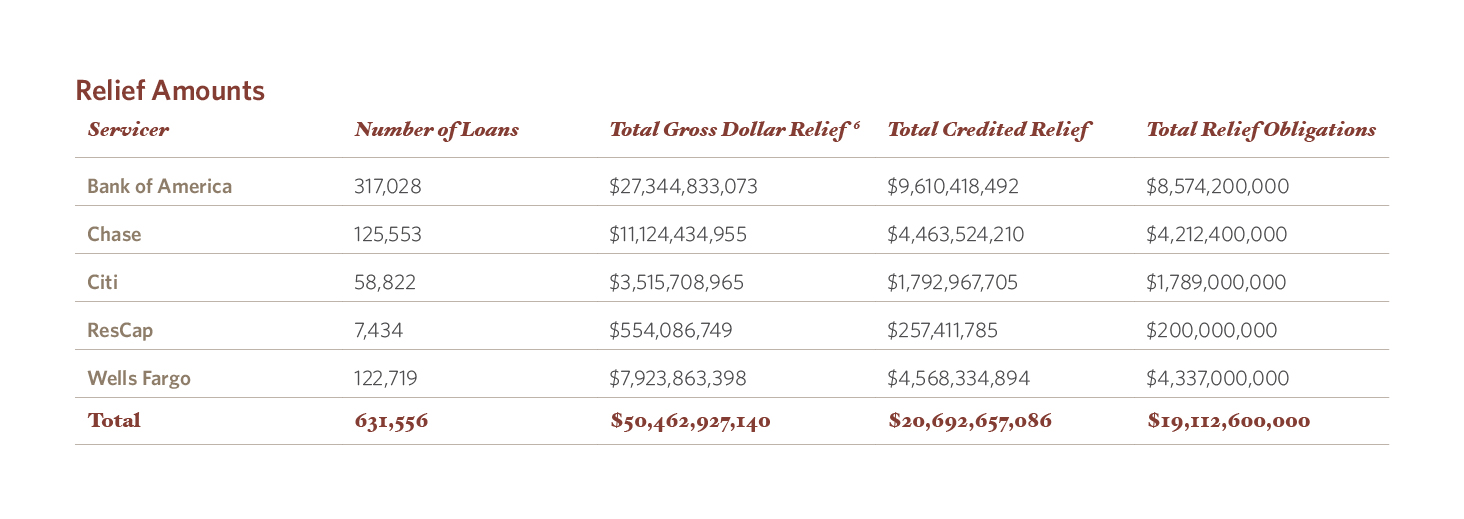

Relief Amounts

Bank of America

Number of Loans: 317,028 Total Gross Dollar Relief6: $27,344,833,073 Total Credited Relief: $9,610,418,492

Chase

Number of Loans: 125,553 Total Gross Dollar Relief6: $11,124,434,955 Total Credited Relief: $4,463,524,210

Citi

Number of Loans: 58,822 Total Gross Dollar Relief6: $3,515,708,965 Total Credited Relief: $1,792,967,705

ResCap

Number of Loans: 7,434 Total Gross Dollar Relief6: $554,086,749 Total Credited Relief: $257,411,785

Wells Fargo

Number of Loans: 122,719 Total Gross Dollar Relief6: $7,923,863,398 Total Credited Relief: $4,568,334,894

Total

Number of Loans: 631,556 Total Gross Dollar Relief6: $50,462,927,140 Total Credited Relief: $20,692,657,086

Click to view image

Click to view image

The gross dollar relief summarized above is slightly different than the gross dollar relief the servicers previously reported in their State Reports, which I summarized in Final Progress Report. Following exchanges between the IRGs and my PPF, my PPF and I have not identified any material inaccuracies in the servicers’ State Reports. Differences occurred when I determined that certain loans were not eligible for credit or the servicers decided not to seek credit for particular loans.

Additionally, on the basis of the review conducted by my PPF and other professionals, I have no reason to believe that any of the servicers failed to comply with the non-creditable consumer relief requirements previously discussed.

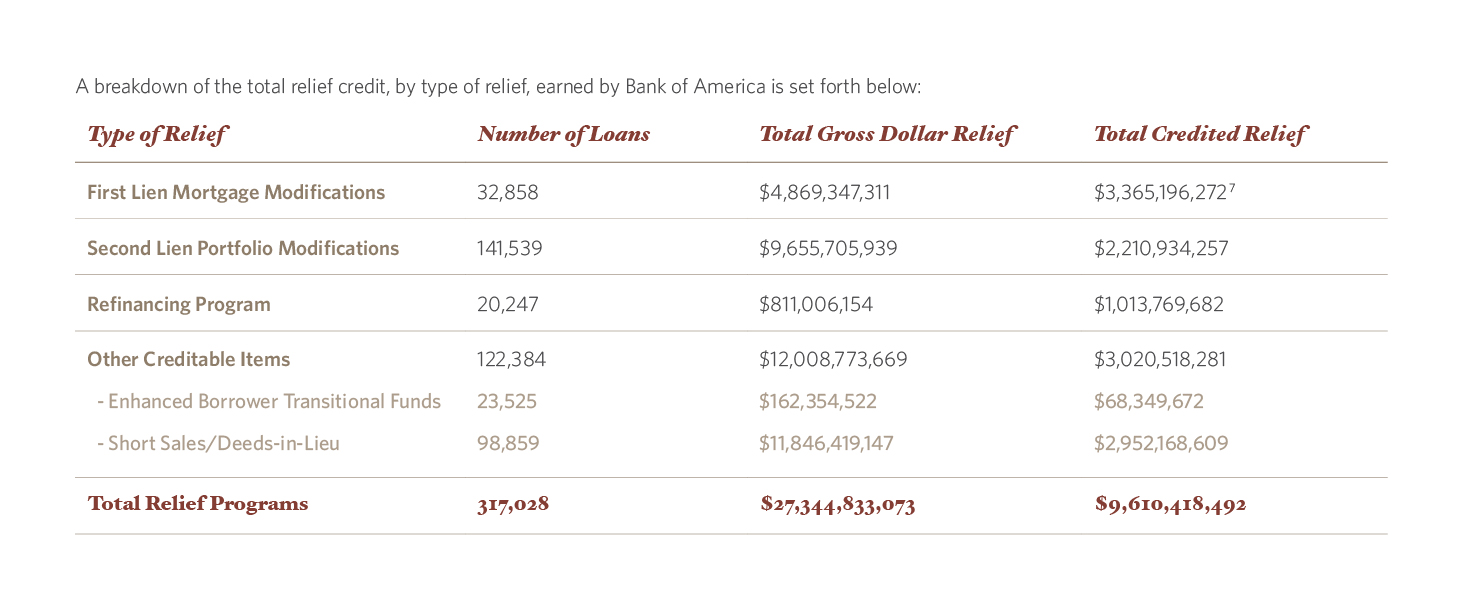

Bank of America Results

Score Card: Bank of America Relief Crediting

- More than 35 percent of Bank of America’s total earned credit from relief activities was through first lien mortgage modifications, and approximately 11 percent was through refinancing relief.

- Second lien portfolio modifications made up approximately 23 percent of Bank of America’s total earned credit.

- Short sales and other types of consumer relief made up approximately 31 percent of Bank of America’s total earned credit.

- Approximately 61 percent of the total earned credit was a result of relief afforded to borrowers on loans in Bank of America’s mortgage loan portfolio that is held for investment; and the remainder was a result of relief afforded to borrowers on loans that Bank of America was servicing for other investors.

Total Credited Relief for Bank of America - $9,610,418,492

Gross vs. credited consumer relief for Bank of America

Breakdown of Total Relief Credit by Type of Relief for Bank of America

First Lien Mortgage Modifications

Number of Loans: 32,858

Total Gross Dollar Relief : $4,869,347,311

Total Credited Relief: $3,365,196,2727

Second Lien Portfolio Modifications

Number of Loans: 141,539

Total Gross Dollar Relief : $9,655,705,939

Total Credited Relief: $2,210,934,257

Refinancing Program

Number of Loans: 20,247

Total Gross Dollar Relief : $811,006,154

Total Credited Relief: $1,013,769,682

Other Creditable Items

Number of Loans: 122,384

Total Gross Dollar Relief : $12,008,773,669

Total Credited Relief: $3,020,518,281

-

Enhanced Borrower Transitional Funds

Number of Loans: 23,525

Total Gross Dollar Relief : $162,354,522

Total Credited Relief: $68,349,672

-

Short Sales/Deeds-in-Lieu

Number of Loans: 98,859

Total Gross Dollar Relief : $11,846,419,147

Total Credited Relief: $2,952,168,609

Total Relief Programs

Number of Loans: 317,028

Total Gross Dollar Relief : $27,344,833,073

Total Credited Relief: $9,610,418,492

Click to view image

Click to view image

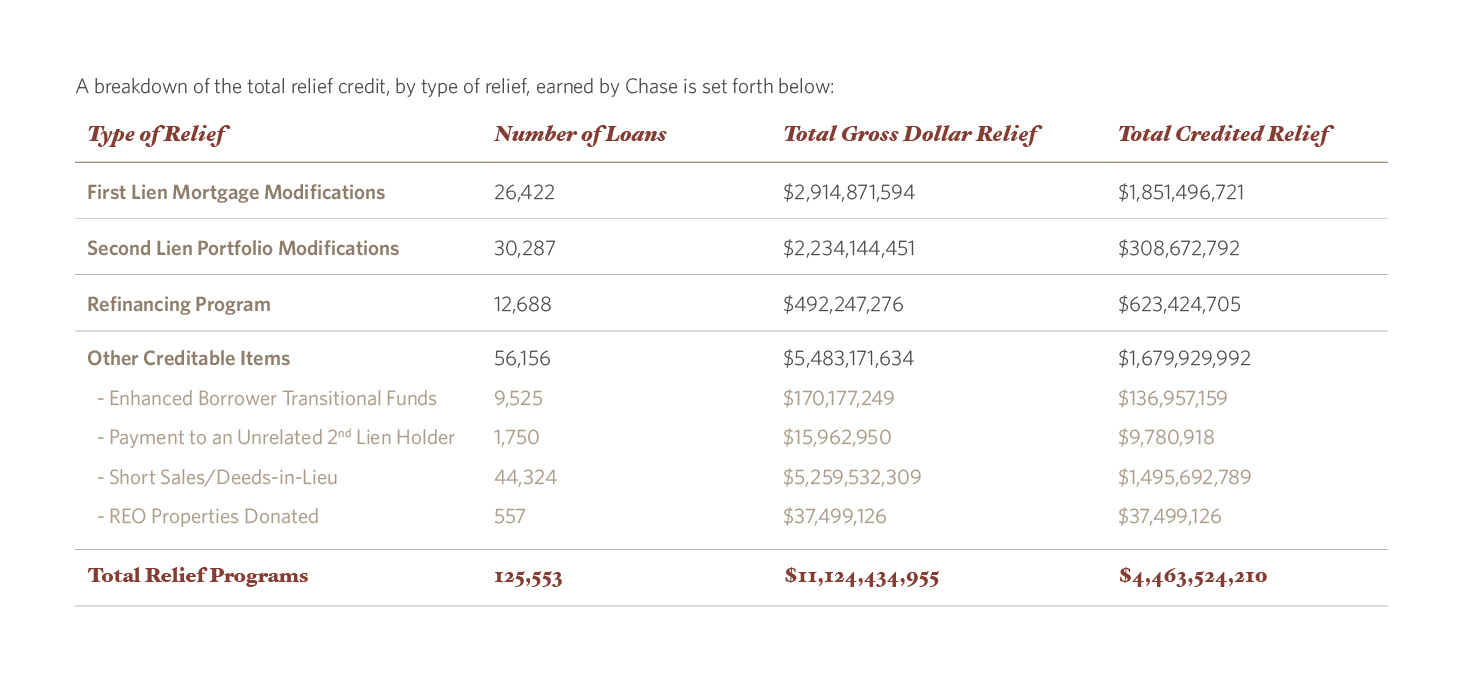

Chase Results

I have confirmed that Chase completed $4,463,524,210 in total credited relief and has therefore completed its relief obligations. Chase’s report to the Court can be found here.

Scorecard: Chase Relief Crediting

- More than 41 percent of Chase’s total earned credit from relief activities was through first lien mortgage modifications, and approximately 14 percent was through refinancing relief.

- Second lien portfolio modifications made up approximately 7 percent of Chase’s total earned credit.

- Short sales and other types of consumer relief made up approximately 38 percent of Chase’s total earned credit.

- Approximately 71 percent of the total earned credit was a result of relief afforded to borrowers on loans in Chase’s mortgage loan portfolio that is held for investment, and the remainder was a result of relief afforded to borrowers on loans that Chase was servicing for other investors.

Total Credited Relief - Chase

A Breakdown of Total Credit, by Type of Relief, Earned by Chase

First Lien Mortgage Modifications

Number of Loans: 26,422

Total Gross Dollar Relief : $2,914,871,594

Total Credited Relief: $1,851,496,721

Second Lien Portfolio Modifications

Number of Loans: 30,287

Total Gross Dollar Relief : $2,234,144,451

Total Credited Relief: $308,672,792

Refinancing Program

Number of Loans: 12,688

Total Gross Dollar Relief : $492,247,276

Total Credited Relief: $623,424,705

Other Creditable Items

Number of Loans: 56,156

Total Gross Dollar Relief : $5,483,171,634

Total Credited Relief: $1,679,929,992

-

Enhanced Borrower Transitional Funds

Number of Loans: 9,525

Total Gross Dollar Relief : $170,177,249

Total Credited Relief: $136,957,159

-

Short Sales/Deeds-in-Lieu

Number of Loans: 1,750

Total Gross Dollar Relief : $15,962,950

Total Credited Relief: $9,780,918

REO Properties Donated

Number of Loans: 557

Total Gross Dollar Relief : $37,499,126

Total Credited Relief: $37,499,126

Total Relief Programs

Number of Loans: 125,553

Total Gross Dollar Relief: $11,124,434,955

Total Credited Relief: $4,463,524,210

Click to view image

Click to view image

Gross vs. Credited Consumer Relief - Chase

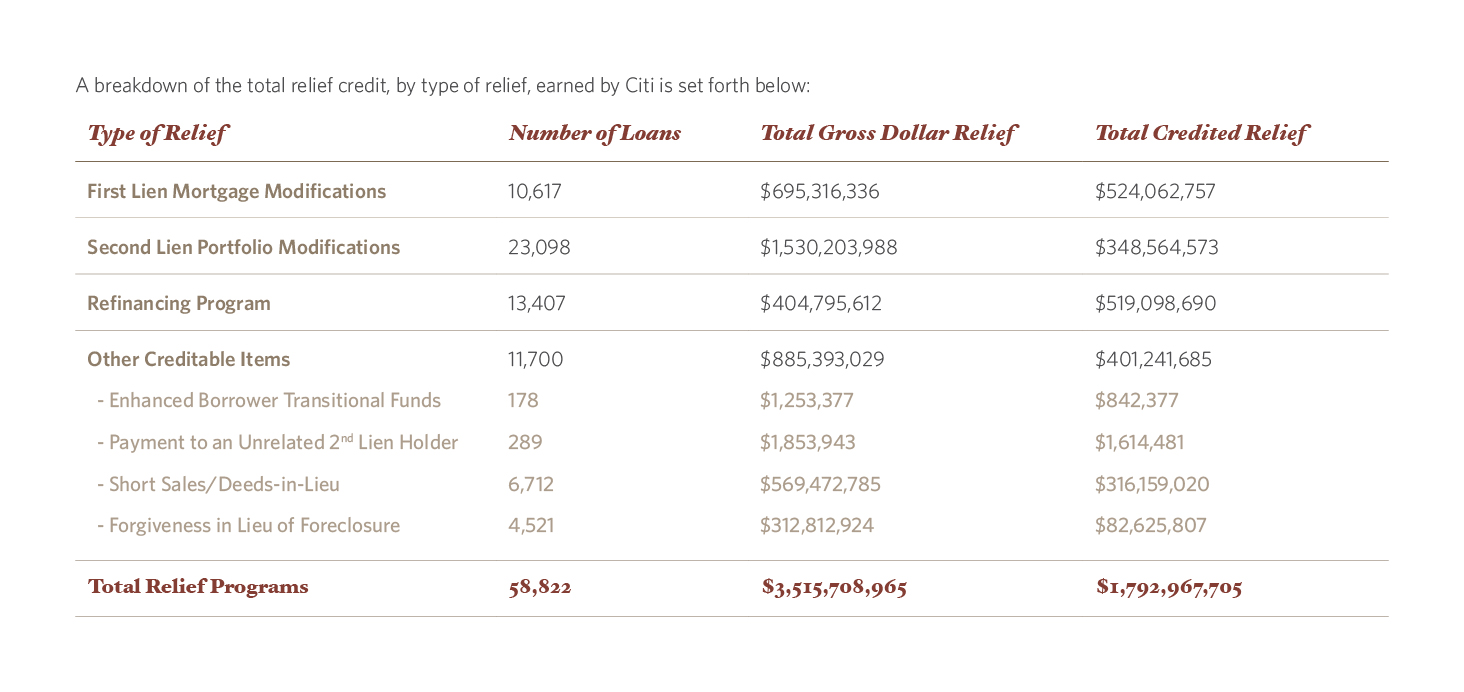

Citi Results

I have confirmed that Citi completed $1,792,967,705 in total credited relief and has therefore completed its relief obligations. Citi’s report to the Court can be found here.

Score Card: Citi Relief Crediting

-

More than 29 percent of Citi’s total earned credit from relief activities was through first lien mortgage modifications, and approximately 29 percent was through refinancing relief.

-

Second lien portfolio modifications made up approximately 20 percent of Citi’s total earned credit.

-

Short sales and other types of consumer relief made up approximately 22 percent of Citi’s total earned credit.

- Approximately 99.6 percent of the total earned credit was a result of relief afforded to borrowers on loans in Citi’s mortgage loan portfolio that is held for investment. The remainder was a result of relief afforded to borrowers on loans that Citi was servicing for other investors.

Total Credited Relief for Citi - $1,792,967,705

A breakdown of the total relief credit, by type of relief, earned by Citi is set forth below:

First Lien Mortgage Modifications

Number of Loans: 10,617

Total Gross Dollar Relief : $695,316,336

Total Credited Relief: $524,062,757

Second Lien Portfolio Modifications

Number of Loans: 23,098

Total Gross Dollar Relief : $1,530,203,988

Total Credited Relief: $348,564,573

Refinancing Program

Number of Loans: 13,407

Total Gross Dollar Relief : $404,795,612

Total Credited Relief: $519,098,690

Other Creditable Items

Number of Loans: 11,700

Total Gross Dollar Relief : $885,393,029

Total Credited Relief: $401,241,685

-

Enhanced Borrower Transitional Funds

Number of Loans: 178

Total Gross Dollar Relief : $1,253,377

Total Credited Relief: $842,377

-

Payment to an Unrelated 2nd Lien Holder

Number of Loans: 289

Total Gross Dollar Relief : $1,853,943

Total Credited Relief: $1,614,481

-

Short Sales/Deeds-in-Lieu

Number of Loans: 6,712

Total Gross Dollar Relief : $569,472,785

Total Credited Relief: $316,159,020

-

Forgiveness in Lieu of Foreclosure

Number of Loans: 4,521

Total Gross Dollar Relief : $312,812,924

Total Credited Relief: $82,625,807

Total Relief Programs

Number of Loans: 58,822

Total Gross Dollar Relief : $3,515,708,965

Total Credited Relief: $1,792,967,705

Click to view image

Click to view image

Gross vs. credited consumer relief for Citi

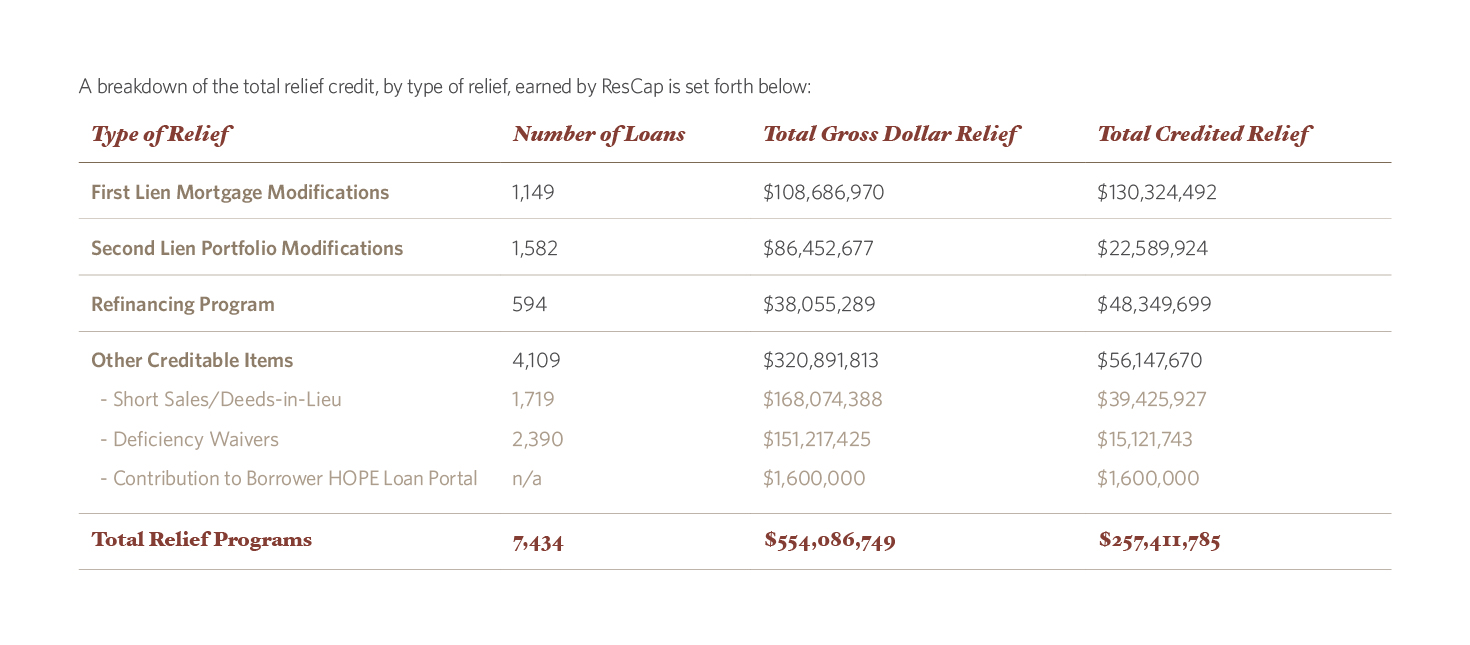

ResCap Results

Score Card: ResCap Relief Crediting

- More than 50 percent of ResCap’s total earned credit from relief activities was through first lien mortgage modifications, and approximately 19 percent was through refinancing relief.

- Second lien portfolio modifications made up approximately 9 percent of ResCap’s total earned credit.

- Short sales and other types of consumer relief made up approximately 22 percent of ResCap’s total earned credit.

- Approximately 84 percent of the total earned credit was a result of relief afforded to borrowers on loans in the ResCap mortgage loan portfolio that is held for investment, and the remainder was a result of relief afforded to borrowers on loans that ResCap was servicing for other investors.

Total Credited Relief ResCap - $257,411,785

A breakdown of the total relief credit, by type of relief, earned by ResCap

First Lien Mortgage Modifications

Number of Loans: 1,149

Total Gross Dollar Relief : $108,686,970

Total Credited Relief: $130,324,492

Second Lien Portfolio Modifications

Number of Loans: 1,582

Total Gross Dollar Relief : $86,452,677

Total Credited Relief: $22,589,924

Refinancing Program

Number of Loans: 594

Total Gross Dollar Relief : $38,055,289

Total Credited Relief: $48,349,699

Other Creditable Items

Number of Loans: 4,109

Total Gross Dollar Relief : $320,891,813

Total Credited Relief: $56,147,670

-

Short Sales/Deeds-in-Lieu

Number of Loans: 1,719

Total Gross Dollar Relief : $168,074,388

Total Credited Relief: $39,425,927

-

Deficiency Waivers

Number of Loans: 2,390

Total Gross Dollar Relief : $151,217,425

Total Credited Relief: $15,121,743

-

Contribution to Borrower HOPE Loan Portal

Number of Loans: n/a

Total Gross Dollar Relief : $1,600,000

Total Credited Relief: $1,600,000

Total Relief Programs

Number of Loans: 7,434

Total Gross Dollar Relief : $554,086,749

Total Credited Relief: $257,411,785

Click to view image

Click to view image

Credited Consumer Relief - Rescap

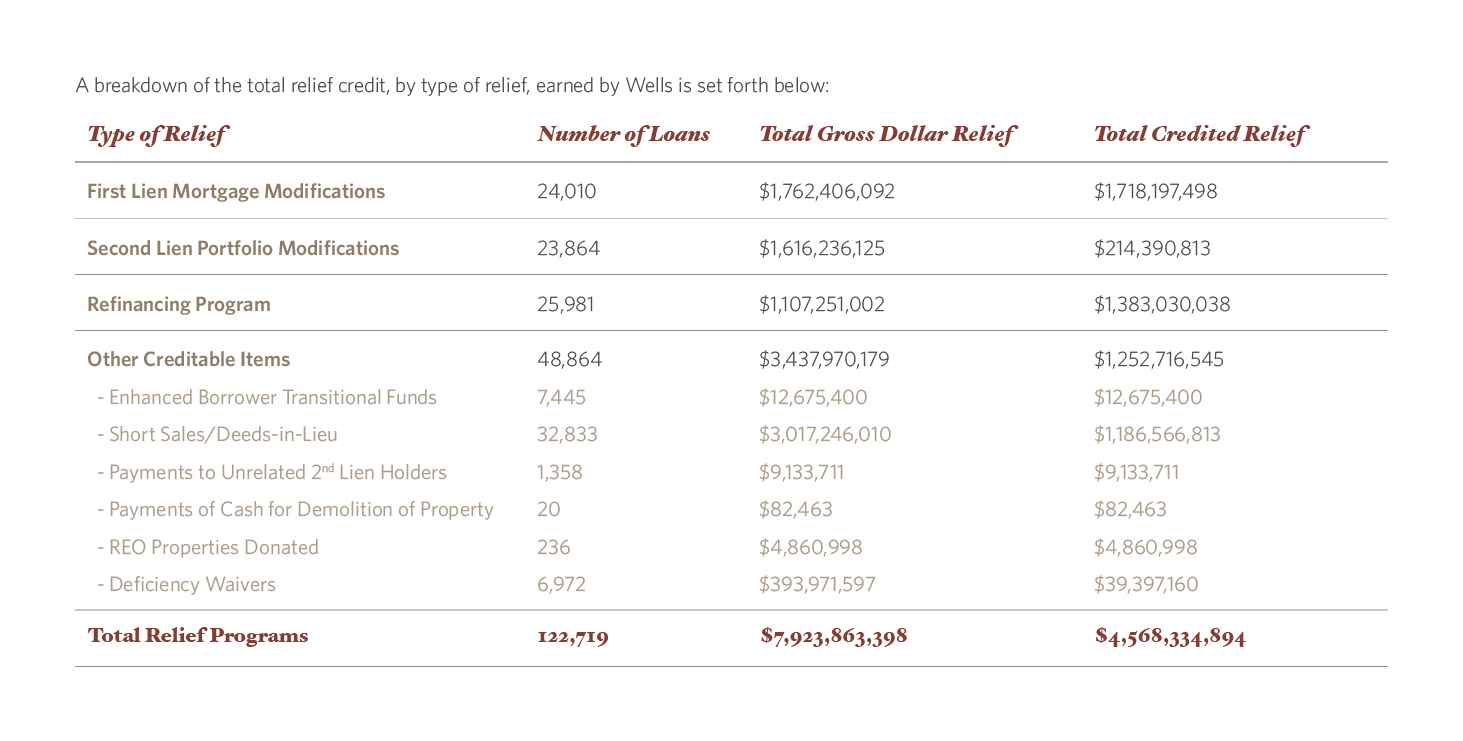

Wells Results

I have confirmed that Wells completed $4,568,334,894 in total credited relief, thus fulfilling its relief obligations under the Settlement. Wells’ report to the Court can be found here.

Score Card: Wells Relief Crediting

- Approximately 38 percent of Wells’ total earned credit from relief activities was through first lien mortgage modifications, and approximately 30 percent was through refinancing relief.

- Second lien portfolio modifications made up approximately 5 percent of Wells’ total earned credit.

- Short sales and other types of consumer relief made up approximately 27 percent of Wells’ total earned credit.

- All but $51,202 of Wells’ $4,568,334,894 credit was the result of relief afforded to borrowers on loans in its mortgage loan portfolio that are held for investment.

Total Credited Relief Wells – $4,568,334,894

A breakdown of the total relief credit, by type of relief, earned by Wells

First Lien Mortgage Modifications

Number of Loans: 24,010

Total Gross Dollar Relief : $1,762,406,092

Total Credited Relief: $1,718,197,498

Second Lien Portfolio Modifications

Number of Loans: 23,864

Total Gross Dollar Relief : $1,616,236,125

Total Credited Relief: $214,390,813

Refinancing Program

Number of Loans: 25,981

Total Gross Dollar Relief : $1,107,251,002

Total Credited Relief: $1,383,030,038

Other Creditable Items

Number of Loans: 48,864

Total Gross Dollar Relief : $3,437,970,179

Total Credited Relief: $1,252,716,545

-

Enhanced Borrower Transitional Funds

Number of Loans: 7,445

Total Gross Dollar Relief : $12,675,400

Total Credited Relief: $12,675,400

-

Short Sales/Deeds-in-Lieu

Number of Loans: 32,833

Total Gross Dollar Relief : $3,017,246,010

Total Credited Relief: $1,186,566,813

-

Payment to an Unrelated 2nd Lien Holder

Number of Loans: 1,358

Total Gross Dollar Relief : $9,133,711

Total Credited Relief: $9,133,711

-

Payments of Cash for Demolition of Property

Number of Loans: 20

Total Gross Dollar Relief : $82,463

Total Credited Relief: $82,463

-

REO Properties Donated

Number of Loans: 236

Total Gross Dollar Relief : $4,860,998

Total Credited Relief: $4,860,998

-

Deficiency Waivers

Number of Loans: 6,972

Total Gross Dollar Relief : $393,971,597

Total Credited Relief: $39,397,160

Total Relief Programs

Number of Loans: 122,719

Total Gross Dollar Relief : $7,923,863,398

Total Credited Relief: $4,568,334,894

Click to view image

Click to view image

Gross vs. credited consumer relief

Conclusion

The crediting reports I have just filed with the Court confirm that the servicers have satisfied their relief obligations under the NMS. This milestone allows me to make several conclusions. First, this bipartisan settlement among 49 states, the federal government and mortgage servicers resulted in an unprecedented amount of consumer relief. Further, the Settlement incentivized the servicers to provide relief early, which meant distressed borrowers benefited from the relief within 18 months of the Settlement’s effective date. The Settlement parties negotiated a strong agreement that allowed me to implement a rigorous review process, keeping the servicers accountable to their obligations and, I hope, inspiring confidence in the government parties and the public that the servicers in fact satisfied their consumer relief and refinancing obligations. My team and I continue to test certain servicers’ consumer relief work for the separate agreements they have with particular states, along with Bank of America’s mandatory solicitation obligations. We also are monitoring the servicers’ compliance with the Settlement’s servicing rules, and I look forward to sharing my next compliance reports with the Court and public later this spring.

Resources

1 I filed reports for Bank of America, CitiMortgage, JPMorgan Chase and Wells Fargo on March 18, 2014. I previously filed a report on the ResCap Parties on February 12, 2013 that included a finding of partial satisfaction of ResCap’s relief obligations under the NMS. I then filed a report on January 23, 2014 that certified ResCap had fulfilled its solicitation requirements and thus completed its relief obligations under the NMS.

2 The Settlement, Exhibit D-1.

3 The Settlement, Exhibit D, 1.b. GSE conforming loan limit caps as of January 1, 2010 are: 1 Unit, $729,750; 2 Units, $934,200; 3 Units, $1,129,250; and 4 Units, $1,403,400.

4 Credit for refinancing is based on the reduction in the loan’s interest rate multiplied by the unpaid principal balance of the loan times a multiplier reflecting the term of the interest rate reduction. If the new rate applies for the life of the loan, the multiplier is eight for loans with a remaining term greater than 15 years, six for loans with a remaining term of 10 to 15 years, and five for loans with a remaining term less than 10 years. If the new rate applies for at least five years, but less than the remaining term of the loan, the multiplier is five.

5 I had earlier filed an interim report for ResCap in February 2013. I filed its final report in January 2014.

6 For refinanced loans, Total Gross Dollar Relief is the sum of the estimated benefit to borrowers from refinancing. The estimated benefit to a borrower whose loan was refinanced is determined by first calculating the product of the reduction of the interest rate and the unpaid principal balance of the loan and then multiplying that amount by a multiplier of 7.85, which represents the average period in which the reduced interest rate will be in effect. This multiplier is consistent with what some of the servicers have reported in their filings with the U.S. Securities and Exchange Commission.

7 Bank of America exceeded by more than $850,000,000 its minimum first lien mortgage modification requirement of $2,287,860,000. As a result, Bank of America is relieved of the obligation set forth in the Settlement to make a deferred payment of that amount.